The Finance Department is responsible for administering all fiscal affairs of the city, including assisting the Mayor and City Council in developing the annual budget, managing the city’s investments, reviewing purchases and overseeing debt.

Strongsville has been awarded the Certificate of Achievement for Excellence in Financial Reporting by the Government Finance Officers Association of the United States and Canada for its Comprehensive Annual Financial Report.

Finance Director Eric Dean and his staff have been honored for the last ten years with the prestigious Award for Financial Reporting Achievement from the GFOA.

Income Tax

Strongsville income taxes are collected by the Regional Income Tax Agency (RITA). All Strongsville residents 18 and older must file a city tax return regardless of whether taxes are owed. Residents who are under 18 who worked and had local taxes withheld in the city of Strongsville are eligible for a refund through Form 10A.

For forms and information, contact RITA at (440) 526-0900, toll-free at (800) 860-7482 or online at ritaohio.com.

The Strongsville income tax rate is 2 percent, with a credit of .75 percent up to 2 percent of taxes paid to the city where a resident works.

Income taxes are the single largest source of income for the city and are used for many services, including police, fire, street repairs, recreation and refuse collection.

Interest Rate

Based on the calculations required by House Bill 5, the annual interest rate is 5 percent for calendar year 2016; 6 percent for 2017 and 2018; 7 percent for 2019 and 2020; and 5 percent for 2021.

Property Tax

Property taxes are collected by Cuyahoga County.

The current residential millage in Strongsville is 126.00, with an effective rate of 77.56 mills for tax year 2020, which is collected in 2021.

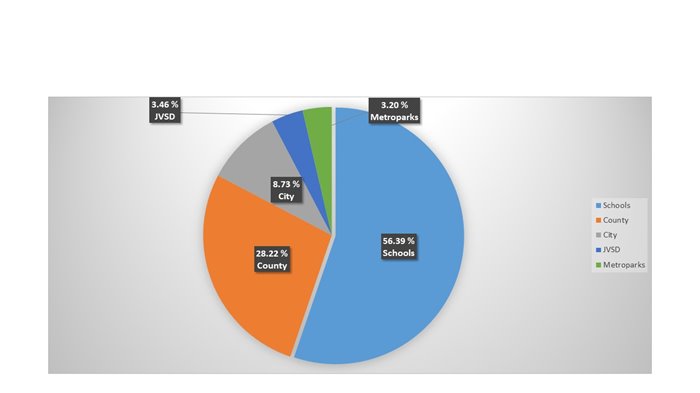

Here's how your property taxes are allocated:

Collection Year 2022 Property Tax Allocation

According to the Cuyahoga County Treasurer's Office, you can estimate your property tax bill in Strongsville by multiplying the value of your home by 2.1584 percent.

For information on your real estate taxes, visit the Cuyahoga County Treasurer’s Office, call (216) 443-7400, or email treascomment@cuyahogacounty.us.

Sewer Fees

Sewer fees are calculated based on your consumption as measured by your water meter and billed by the Cleveland Division of Water. If you have a question about water or sewer billing, please contact Cleveland Water at (216) 664-3130.

The same local rate is charged for all Strongsville customers. You may receive two bills – a water bill from Cleveland and a separate bill from the Northeast Ohio Regional Sewer District – or you may receive one bill that includes both your water and sewer fees, depending on the area of the city you live in.

Sewer rates are adjusted every January 1, as outlined in Section 1048.03 of the Codified Ordinances of the City of Strongsville.

An administrative fee of $3.33 a month is included on bills.

To receive Homestead Exemption discounts on water and sewer bills, you must apply each year to the Cleveland Division of Water. The discounts are based on age and income.